What does this mean for my property, and for me?

You have several potential options to deal with this issue Learn moreProceeds from tax lien sales are used to fund municipal services, such as schools, fire and police services.

Schools

Fire / Police Stations

Roads

Parks

FAQs

I have a question about paying off Kentucky property taxes

How much do I owe?

Welcome!

TLS Unlimited, on behalf of our investor clients, is dedicated to helping taxpayers redeem, or “pay off” their delinquent property taxes. For over ten years, we have worked to provide caring service to taxpayers, from our offices throughout the United States.

If you need assistance paying your delinquent taxes, or are having difficulty understanding the process, please visit our Information for Taxpayers page. We have also answered more specific questions for delinquent taxes in Kentucky.

Above all, we invite you to contact our team members at any time with additional questions, or to request a payoff quote.

How Tax Liens Work

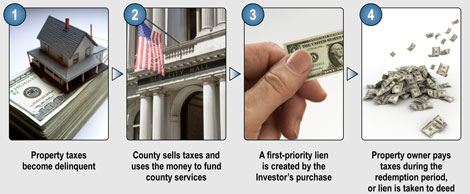

Many states require their counties and municipalities to sell tax liens to the public when property taxes are delinquent. Investors acquire property tax liens primarily to earn statutory interest on their investment. States would rather have their counties receive cash instead of a receivable. The proceeds from tax lien sales are used to fund municipal services, such as schools, fire and police services, and so on. Each state has its own statutes that regulate the sale of tax liens. With the purchase, the investor is assigned the county’s legal rights to collect the delinquent taxes being sold.

Business Process

TLS acquires real estate tax liens from states, counties, and municipalities that subsequently use the money to fund government services, such as primary education. We research the properties underlying these tax liens, then buy desirable properties for our investor clients. After property owners are notified of the lien purchase, back taxes and statutory interest are paid to TLS and then forwarded to the county. The lien on the property is then released.

Most of our liens redeem within the statutory redemption period, which is generous, but varies by municipality. In a small number of instances, it may be necessary for TLS to take title to the property and sell it, in order to recover the investment.

Reach A Team Member

Contact Our Team members at any time with additional questions, or to request a payoff quote.